In 2026, the U.S. market is estimated to reach USD 4.20 billion.

PUNE, MAHARASHTRA, INDIA, February 4, 2026 /EINPresswire.com/ — The global enterprise firewall market size 2026 demonstrates robust growth momentum driven by escalating cybersecurity threats and digital transformation initiatives across industries. Organizations worldwide are transitioning from traditional perimeter defenses to sophisticated next-generation firewall architectures that integrate cloud capabilities, artificial intelligence, and zero-trust frameworks.

Get a Free Sample PDF – https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/enterprise-firewall-market-114731

Market Size and Forecast

The enterprise firewall market was valued at USD 2.40 billion in 2025 and is projected to expand from USD 2.61 billion in 2026 to USD 5.77 billion by 2034. This represents a compound annual growth rate of 10.2% throughout the forecast period. The market’s expansion reflects the increasing necessity for advanced network protection as businesses navigate complex hybrid environments combining on-premises infrastructure with multi-cloud deployments.

Key Market Drivers

Rising Cyber Threat Sophistication

The growing frequency and complexity of cyberattacks constitute the primary driver of enterprise firewall adoption. Modern threat actors employ encrypted communication channels, multi-stage intrusion techniques, and automated attack tools that render traditional firewalls ineffective. Organizations require next-generation firewalls equipped with deeper inspection capabilities, real-time analytics, and integrated threat intelligence to counter these evolving risks. As adversaries target both cloud and on-premises environments simultaneously, businesses prioritize security investments providing consistent protection across all network layers.

The sophistication escalation was highlighted in November 2025 when Cisco Systems issued alerts regarding attacks exploiting zero-day vulnerabilities in ASA and Secure Firewall devices, demonstrating how outdated hardware becomes an entry point for advanced adversaries.

Hybrid and Multi-Cloud Migration

Organizations increasingly operate distributed environments spanning public clouds, private data centers, and edge locations. This architectural shift creates demand for virtual firewalls, cloud-native security solutions, and firewall-as-a-service offerings capable of enforcing unified policies across dispersed infrastructure. The need for consistent policy enforcement regardless of workload location drives adoption of solutions integrating seamlessly with Secure Access Service Edge and zero-trust architectures.

Generative AI Integration

Generative AI is transforming firewall capabilities through enhanced threat detection using models trained on massive traffic volumes to identify subtle, previously unseen attack patterns in near real-time. Vendors embed AI-assisted policy tuning and configuration tools that reduce administrative workload, enabling smaller security teams to operate complex environments. Fortinet’s March 2025 expansion of its FortiAI assistant across the Security Fabric platform exemplifies this trend toward autonomous threat protection.

Market Segmentation Insights

Solution Type

Hardware solutions captured the largest market share in 2025 at USD 8.78 billion, driven by large enterprise dependence on high-performance appliance-based firewalls protecting campus networks, data centers, and latency-sensitive environments. These organizations prioritize dedicated hardware for reliability, throughput capacity, and ability to handle advanced threat inspection at scale.

Software solutions are anticipated to grow at the highest CAGR of 11.1% during the forecast period. Organizations increasingly adopt virtual firewalls and subscription-based models providing greater flexibility and lower upfront costs compared to traditional appliances.

Deployment Model

Cloud deployment generated revenue of USD 9.71 billion in 2025, establishing segment dominance. Enterprises continue shifting workloads to multi-cloud and hybrid environments requiring firewall controls that scale elastically while providing consistent policy enforcement across distributed users and applications. Cloud-delivered security appeals through lower upfront investment, simplified management, and seamless integration with SASE and zero-trust frameworks.

Cloud deployment is expected to grow at the highest CAGR of 11.6% during the forecast period, reflecting the preference for unified policy management, faster deployment, and reduced operational overhead inherent in cloud-delivered platforms.

Enterprise Size

Large enterprises attained the largest market share with revenue of USD 9.23 billion in 2025. These organizations operate complex, globally distributed networks demanding advanced firewall capabilities, high throughput performance, and extensive segmentation. Substantial cybersecurity budgets and stricter compliance mandates drive higher adoption of next-generation, cloud-based, and integrated firewall platforms.

Small and medium-sized enterprises are expected to grow at the highest CAGR of 12.7% during the forecast period. SME digitalization accelerates adoption of cloud services, driving demand for affordable, easily deployed firewall and managed security solutions.

Industry Vertical

The Banking, Financial Services, and Insurance sector accounted for the largest market share with a valuation of USD 3.36 billion in 2025. The sector’s handling of highly sensitive data coupled with strict regulatory requirements necessitates advanced firewall protection and continuous monitoring. Frequent sophisticated cyberattacks prompt elevated investment in next-generation and cloud-integrated solutions.

Healthcare is projected to grow at the highest CAGR of 13.0% during the forecast period. Rapid digitalization of patient records, proliferation of connected medical devices, and expansion of telehealth services increase exposure to cyber threats, driving substantial security investment.

Speak To Analyst- https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/enterprise-firewall-market-114731

Regional Analysis

North America Leadership

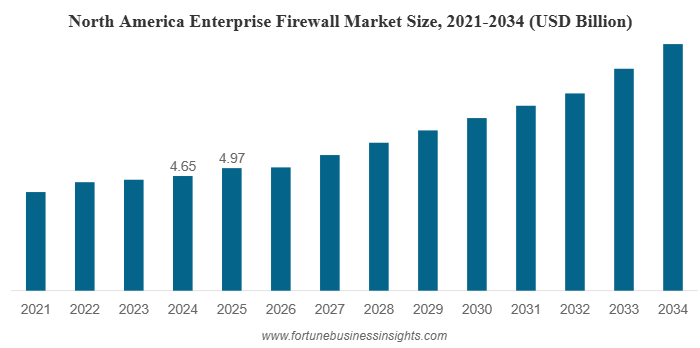

North America held the largest market share in 2024 valued at USD 4.65 billion, maintaining leadership in 2025 with USD 4.97 billion. The region’s mature cybersecurity landscape features enterprises adopting advanced firewalls, zero-trust frameworks, and cloud-based platforms faster than other regions. Major vendor presence, strict regulatory standards, and high frequency of sophisticated attacks drive strong investment in next-generation solutions.

The United States market is estimated to reach USD 4.20 billion in 2026, propelled by advanced cyberattacks targeting critical infrastructure, government networks, and large enterprises. Rapid adoption of hybrid cloud, remote work models, and zero-trust architectures pushes organizations to upgrade to scalable, policy-driven platforms securing distributed users and applications.

Asia Pacific Growth

Asia Pacific is estimated to reach USD 3.73 billion in 2026 while registering the highest CAGR of 12.9% for the forecast period. Rapid digitalization across China, India, Southeast Asia, and Japan increases network complexity and cyber exposure. Government and enterprise investment in cloud adoption, data protection regulations, and zero-trust initiatives drives strong demand for next-generation solutions.

India will gain a market value of USD 0.50 billion in 2026, while China is estimated to account for USD 0.79 billion, reflecting the region’s substantial growth potential.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()